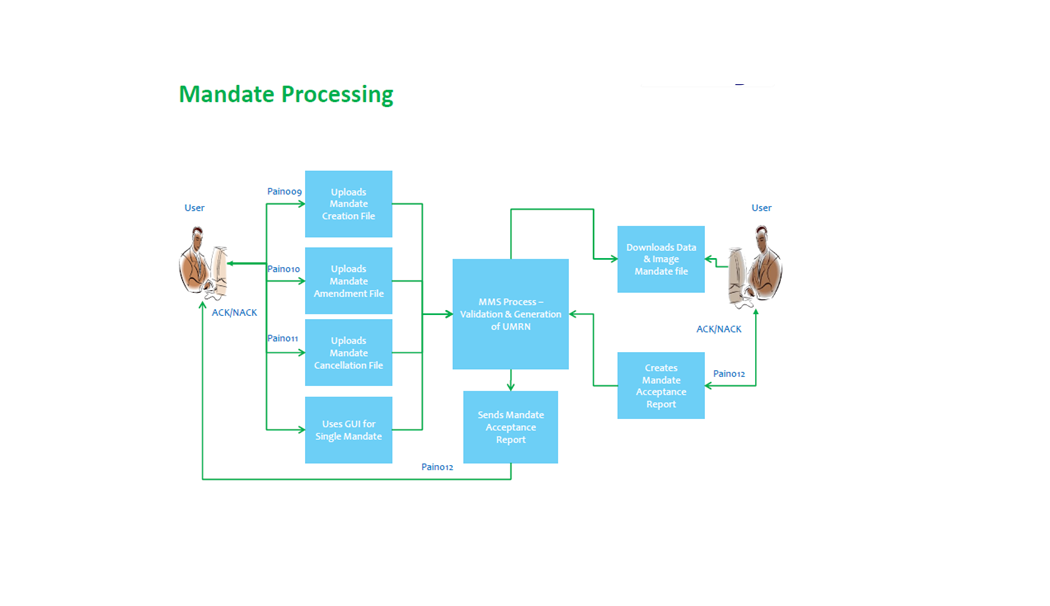

A Mandate Management System (MMS) is a solution which helps in creation, amendment and cancellation of mandates used for NACH debit transactions. The MMS handles mandate processing and validation and forward the data to relevant destination via NPCI. The system also handles incoming data from destination via NPCI and updates the records and stakeholders accordingly. The system is designed according to NPCI guidelines, practices and standards. Security, messages and other standards need to be maintained as required by NPCI.

Our proposed MMS solution is web-enabled for all including scanning, data capture, enables and ensures integration for multi location, multi institutional end to end debit and credit transactions derived from the mandates.